30 • URNER BARRY'S REPORTER / VOL. 19, NO. 1 / WINTER 2024

Ecuador is a South American country of 18 million people that

straddles the equator on the west coast of the continent. Their

chief exports include crude oil and derivatives, shrimp, bananas,

coffee, cut flowers, cocoa, and Panama hats, which they ship to

destinations like the United States, Peru, China, Chile, and Panama.

While large-scale shrimp production has been in Ecuador for

more than 50 years, it's the growth in the last decade-plus that is

remarkable. In fact, in recent years, Ecuador's shrimp industry is

the fastest growing major aquaculture industry in the world! Output

of vannamei (white leg) shrimp has grown from roughly 200,000

metric tonnes in 2010 to 1.25 million metric tonnes in 2022.

The growth in Ecuador shrimp production doesn't look like it is

slowing down anytime soon as the industry there looks to establish

dominance globally. Data released from Camara Nacional De

Acuacultura (CAN) through September shows a 15% increase

in exports over the same period last year despite unfavorable

pricing trends.

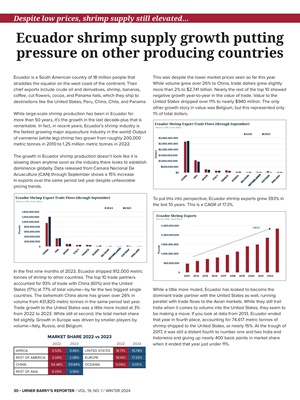

In the first nine months of 2023, Ecuador shipped 912,000 metric

tonnes of shrimp to other countries. The top 10 trade partners

accounted for 93% of trade with China (60%) and the United

States (17%) at 77% of total volume-by far the two biggest single

countries. The behemoth China alone has grown over 26% in

volume from 431,820 metric tonnes in the same period last year.

Trade growth to the United States was a little more muted at 3%

from 2022 to 2023. While still at second, the total market share

fell slightly. Growth in Europe was driven by smaller players by

volume-Italy, Russia, and Belgium.

This was despite the lower market prices seen so far this year.

While volume grew over 26% to China, trade dollars grew slightly

more than 2% to $2.741 billion. Nearly the rest of the top 10 showed

negative growth year-to-year in the value of trade. Value to the

United States dropped over 11% to nearly $940 million. The only

other growth story in value was Belgium, but this represented only

1% of total dollars.

To put this into perspective, Ecuador shrimp exports grew 393% in

the last 10 years. This is a CAGR of 17.3%.

While a little more muted, Ecuador has looked to become the

dominant trade partner with the United States as well, running

parallel with trade flows to the Asian markets. While they still trail

India when it comes to volume into the United States, they seem to

be making a move. If you look at data from 2013, Ecuador ended

that year in fourth place, accounting for 74,617 metric tonnes of

shrimp shipped to the United States, or nearly 15%. At the trough of

2017, it was still a distant fourth to number one and two India and

Indonesia and giving up nearly 400 basis points in market share

when it ended that year just under 11%.

Despite low prices, shrimp supply still elevated…

Ecuador shrimp supply growth putting

pressure on other producing countries

0

200,000,000

400,000,000

600,000,000

800,000,000

1,000,000,000

1,200,000,000

1,400,000,000

Pounds

Ecuador Shrimp Export Trade Flows (through September)

2022 2023

Source: CNA, Urner Barry

$0

$500,000,000

$1,000,000,000

$1,500,000,000

$2,000,000,000

$2,500,000,000

$3,000,000,000

Ecuador Shrimp Export Trade Flows (through September)

2022 2023

Source: CNA, Urner Barry

Dollars

0

500,000,000

1,000,000,000

1,500,000,000

2,000,000,000

2,500,000,000

2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

Pounds Ecuador Shrimp Exports

Source: CNA, Urner Barry

+393%

MARKET SHARE 2022 vs 2023

2022 2023 2022 2023

AFRICA 0.53% 0.46% UNITED STATES 18.71% 16.78%

REST OF AMERICA 2.04% 2.08% EUROPE 18.14% 17.23%

CHINA 54.48% 59.84% OCEANÍA 0.06% 0.05%

REST OF ASIA 6.05% 3.56%