48 • URNER BARRY'S REPORTER / VOL. 18, NO. 4 / FALL 2023

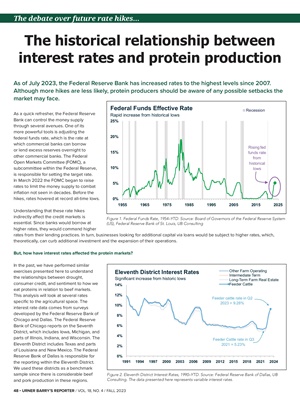

As a quick refresher, the Federal Reserve

Bank can control the money supply

through several avenues. One of its

more powerful tools is adjusting the

federal funds rate, which is the rate at

which commercial banks can borrow

or lend excess reserves overnight to

other commercial banks. The Federal

Open Markets Committee (FOMC), a

subcommittee within the Federal Reserve,

is responsible for setting the target rate.

In March 2022 the FOMC began to raise

rates to limit the money supply to combat

inflation not seen in decades. Before the

hikes, rates hovered at record all-time lows.

Understanding that these rate hikes

indirectly affect the credit markets is

essential. Since banks would borrow at

higher rates, they would command higher

rates from their lending practices. In turn, businesses looking for additional capital via loans would be subject to higher rates, which,

theoretically, can curb additional investment and the expansion of their operations.

But, how have interest rates affected the protein markets?

In the past, we have performed similar

exercises presented here to understand

the relationships between drought,

consumer credit, and sentiment to how we

eat proteins in relation to beef markets.

This analysis will look at several rates

specific to the agricultural space. The

interest rate data comes from surveys

developed by the Federal Reserve Bank of

Chicago and Dallas. The Federal Reserve

Bank of Chicago reports on the Seventh

District, which includes Iowa, Michigan, and

parts of Illinois, Indiana, and Wisconsin. The

Eleventh District includes Texas and parts

of Louisiana and New Mexico. The Federal

Reserve Bank of Dallas is responsible for

the reporting within the Eleventh District.

We used these districts as a benchmark

sample since there is considerable beef

and pork production in these regions.

The debate over future rate hikes…

The historical relationship between

interest rates and protein production

0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

1

0%

5%

10%

15%

20%

25%

1955 1965 1975 1985 1995 2005 2015 2025

Federal Funds Effective Rate

Rapid increase from historical lows

Recession

Risingfed

funds rate

from

historical

lows

Feeder Cattle rate in Q3

2021 = 5.23%

Feeder cattle rate in Q2

2023 = 9.28%

0%

2%

4%

6%

8%

10%

12%

14%

1991 1994 1997 2000 2003 2006 2009 2012 2015 2018 2021 2024

Eleventh District Interest Rates

Significant increase from historic lows

Other Farm Operating

Intermediate Term

Long-Term Farm Real Estate

Feeder Cattle

Figure 1. Federal Funds Rate, 1954-YTD. Source: Board of Governors of the Federal Reserve System

(US), Federal Reserve Bank of St. Louis, UB Consulting

Figure 2. Eleventh District Interest Rates, 1990-YTD. Source: Federal Reserve Bank of Dallas, UB

Consulting. The data presented here represents variable interest rates.

As of July 2023, the Federal Reserve Bank has increased rates to the highest levels since 2007.

Although more hikes are less likely, protein producers should be aware of any possible setbacks the

market may face.