50 • URNER BARRY'S REPORTER / VOL. 18, NO. 4 / FALL 2023

Interest rates...

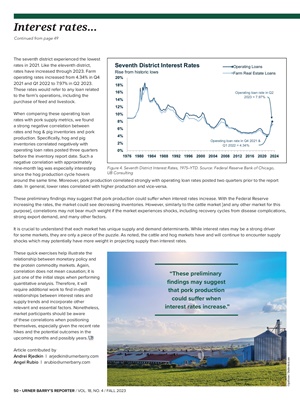

The seventh district experienced the lowest

rates in 2021. Like the eleventh district,

rates have increased through 2023. Farm

operating rates increased from 4.34% in Q4

2021 and Q1 2022 to 7.97% in Q2 2023.

These rates would refer to any loan related

to the farm's operations, including the

purchase of feed and livestock.

When comparing these operating loan

rates with pork supply metrics, we found

a strong negative correlation between

rates and hog & pig inventories and pork

production. Specifically, hog and pig

inventories correlated negatively with

operating loan rates posted three quarters

before the inventory report date. Such a

negative correlation with approximately

nine-month lag was especially interesting

since the hog production cycle hovers

around the same time. Moreover, pork production correlated strongly with operating loan rates posted two quarters prior to the report

date. In general, lower rates correlated with higher production and vice-versa.

These preliminary findings may suggest that pork production could suffer when interest rates increase. With the Federal Reserve

increasing the rates, the market could see decreasing inventories. However, similarly to the cattle market [and any other market for this

purpose], correlations may not bear much weight if the market experiences shocks, including recovery cycles from disease complications,

strong export demand, and many other factors.

It is crucial to understand that each market has unique supply and demand determinants. While interest rates may be a strong driver

for some markets, they are only a piece of the puzzle. As noted, the cattle and hog markets have and will continue to encounter supply

shocks which may potentially have more weight in projecting supply than interest rates.

These quick exercises help illustrate the

relationship between monetary policy and

the protein commodity markets. Again,

correlation does not mean causation; it is

just one of the initial steps when performing

quantitative analysis. Therefore, it will

require additional work to find in-depth

relationships between interest rates and

supply trends and incorporate other

relevant and essential factors. Nonetheless,

market participants should be aware

of these correlations when positioning

themselves, especially given the recent rate

hikes and the potential outcomes in the

upcoming months and possibly years.

Article contributed by

Andrei Rjedkin | arjedkin@urnerbarry.com

Angel Rubio | arubio@urnerbarry.com

Operating loan rate in Q4 2021 &

Q1 2022 = 4.34%

Operating loan rate in Q2

2023 = 7.97%

0%

2%

4%

6%

8%

10%

12%

14%

16%

18%

20%

1976 1980 1984 1988 1992 1996 2000 2004 2008 2012 2016 2020 2024

Seventh District Interest Rates

Rise from historic lows

Operating Loans

Farm Real Estate Loans

Figure 4. Seventh District Interest Rates, 1975-YTD. Source: Federal Reserve Bank of Chicago,

UB Consulting

Continued from page 49

©grafvision / Shutterstock.com

"These preliminary

findings may suggest

that pork production

could suffer when

interest rates increase."