56 • URNER BARRY'S REPORTER / VOL. 18, NO. 4 / FALL 2023

The cattle cycle is a series

of peaks and troughs that

average between eight to 12

years in length. These cycles

are a function of a range of

factors such as the economy,

cattle prices, input costs and

weather cycles. All these

factors play a role in the

industry's decision making

from cow-calf producers to

feeders, all the way up to

the retail store. Each one of

these factors also plays a role

in margins at every level of

production. While the cattle

cycle is not a crystal ball

of the future, we can gain

valuable insights from where

the cycle is and where it may

be heading.

Cattle prices are one of the

largest drivers for decisionmaking at the cow-calf,

feeder, and meatpacker level

of the supply chain. When

cattle prices are depressed

and cow-calf producers are inking red, this usually sends a signal

to the market that the herd is approaching a peak. This will prompt

cow-calf producers to start reducing their herd size and retain less

heifers, in turn, lowering the available supply of market ready cattle

in the future. The opposite can also be said. When cattle prices are

high, this may incentivize producers to expand their herd.

Weather also has one of the larger impacts on decision-making as

cycles progress. More recently we have begun to come out of an

La Niña phase, which has created a significant drought situation in

cattle raising regions. Pasture is one of the most important aspects

of raising beef cattle, as this is "free food." Without grazable land,

producers will be forced to place cattle in feed lots earlier. Which

then lowers profitability for the cow-calf producer and potentially

even for the feeder as the cattle may have to stay on feed longer

to gain market ready weight, further eroding margins. All of this

further drives cattle prices higher at each level.

The latest cycle ended in 2015 when drought conditions pushed

producers to cull their herds for the previous 10 years. The current

cycle appeared to have peaked at around 94.8 million head back

in 2019 and our inventory has trended lower since. The latest

Semi-Annual Cattle Inventory report released by the USDA has

all cattle and calves in the United States at 95.9 million head as

of July 1, about 3% lower than the same time last year. CattleFax

6-State Fed Steer Price surpassed 2015's peak of $169.50/cwt,

making a new record of $187.50/cwt live.

While we have begun to see improvements in pasture across

the United States, we're not sure if there is enough incentive

for expansion just yet. Market sources indicate we are working

towards the bottom of the cycle, but it could still be a couple of

years away. This will have major implications for cattle prices,

beef prices and overall demand levels moving forward. If you are

looking to see when the trend may be breaking, keep an eye on

heifer slaughter levels in the future.

Article contributed by Todd Unger

tunger@urnerbarry.com

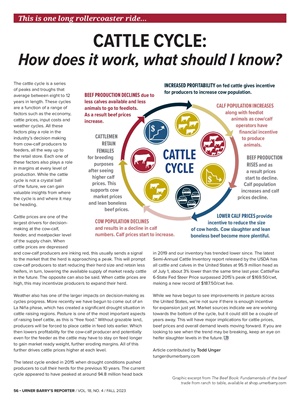

CATTLE CYCLE:

How does it work, what should I know?

This is one long rollercoaster ride…

INCREASED PROFITABILITY on fed cattle gives incentive

for producers to increase cow population.

BEEF PRODUCTION DECLINES due to

less calves available and less

animals to go to feedlots.

As a result beef prices

increase.

LOWER CALF PRICES provide

incentive to reduce the size

of cow herds. Cow slaughter and lean

boneless beef become more plentiful.

CALF POPULATION INCREASES

along with feedlot

animals as cow/calf

operators have

financial incentive

to produce

animals.

BEEF PRODUCTION

RISES and as

a result prices

start to decline.

Calf population

increases and calf

prices decline.

COW POPULATION DECLINES

and results in a decline in calf

numbers. Calf prices start to increase.

CATTLEMEN

RETAIN

FEMALES

for breeding

purposes

after seeing

higher calf

prices. This

supports cow

market prices

and lean boneless

beef prices.

Graphic excerpt from The Beef Book: Fundamentals of the beef

trade from ranch to table, available at shop.urnerbarry.com

CATTLE

CYCLE